5StarsStocks stocks to invest: Maximize Your Returns

Investing in the stock market can be a thrilling yet daunting experience, especially with the ever-changing economic landscape. To help you navigate these waters, we’ve identified the top 5 stars stocks to invest in for 2024. These stocks have been selected based on their strong performance, robust fundamentals, and growth potential. Whether you’re a seasoned investor or a newcomer, this guide will provide you with valuable insights to make informed decisions.

Understanding 5StarsStocks

What is 5StarsStocks?

5StarsStocks refer to stocks that have been rated highly by financial experts and analysts based on a variety of factors. These factors include financial performance, market position, growth potential, and overall stability. Stocks that earn a 5-star rating are considered top-tier investments due to their strong track record and promising outlook.

Importance of Investing in 5StarsStocks

Investing in 5StarsStocks can offer several advantages:

Higher Potential for Returns: These stocks are often leaders in their respective industries, providing a greater chance of substantial returns.

Lower Risk: With strong fundamentals and consistent performance, 5StarsStocks typically pose a lower risk compared to less-established companies.

Top 5 Stars Stocks to Invest in 2024

1. Apple Inc. (AAPL)

Overview: Apple Inc. is a technology giant known for its innovative products such as the iPhone, iPad, and Mac computers. Founded in 1976, Apple has grown to become one of the most valuable companies in the world.

Key Performance Indicators: Apple has consistently demonstrated strong revenue growth, with a reported revenue of $274.5 billion in 2020. The company’s net income has also shown impressive growth, reaching $57.4 billion in the same year.

Investment Potential: With a strong product lineup, expanding services segment, and ongoing innovation, Apple remains a top pick for investors. The company’s commitment to sustainability and new ventures in augmented reality and electric vehicles further enhance its investment appeal.

2. Amazon.com Inc. (AMZN)

Overview: Amazon is a global e-commerce and cloud computing giant founded by Jeff Bezos in 1994. The company has revolutionized online shopping and continues to expand its services and reach.

Key Performance Indicators: Amazon reported a revenue of $469.8 billion in 2021, showcasing significant growth from previous years. The company’s AWS (Amazon Web Services) division is a major contributor to its profitability, with an operating income of $18.5 billion.

Investment Potential: Amazon’s dominance in e-commerce, cloud computing, and recent ventures into healthcare and entertainment make it a compelling investment. The company’s innovative approach and continuous expansion into new markets ensure sustained growth.

3. Tesla Inc. (TSLA)

Overview: Tesla, founded by Elon Musk in 2003, is a leading electric vehicle (EV) manufacturer. The company is known for its cutting-edge technology and commitment to sustainable energy solutions.

Key Performance Indicators: Tesla’s revenue for 2021 was $53.8 billion, reflecting significant growth as the company expands its production capacity. Tesla’s net income reached $5.5 billion, demonstrating improved profitability.

Investment Potential: As a pioneer in the EV industry, Tesla’s growth potential is substantial. The company’s advancements in autonomous driving, energy storage, and global expansion plans position it as a key player in the future of transportation and energy.

4. Microsoft Corporation (MSFT)

Overview: Microsoft, founded by Bill Gates and Paul Allen in 1975, is a technology leader known for its software products, cloud services, and hardware solutions.

Key Performance Indicators: Microsoft reported a revenue of $168 billion for 2021, driven by strong performance in its cloud computing and software segments. The company’s net income was $61.3 billion, reflecting its financial strength.

Investment Potential: With a diverse product portfolio, including Azure cloud services, Office software suite, and gaming with Xbox, Microsoft continues to thrive. The company’s strategic acquisitions and focus on AI and cybersecurity further bolster its long-term growth prospects.

5. Alphabet Inc. (GOOGL)

Overview: Alphabet, the parent company of Google, was founded by Larry Page and Sergey Brin in 1998. The company is a global leader in digital advertising, search engine technology, and various other tech ventures.

Key Performance Indicators: Alphabet reported a revenue of $257.6 billion in 2021, with a significant portion coming from its advertising business. The company’s net income was $76 billion, showcasing its profitability.

Investment Potential: Alphabet’s dominance in digital advertising, continued innovation in AI and cloud computing, and investments in futuristic projects like Waymo (autonomous vehicles) make it a top investment choice. The company’s ability to adapt and grow in a dynamic tech landscape ensures its relevance and success.

How to Evaluate Stocks for Investment

Fundamental Analysis

Key Financial Metrics: When evaluating stocks, consider metrics such as the Price-to-Earnings (P/E) ratio, earnings growth, and return on equity (ROE). These indicators provide insights into a company’s financial health and performance.

Understanding Company Fundamentals: Analyze a company’s balance sheet, income statement, and cash flow statement to assess its financial stability and growth potential.

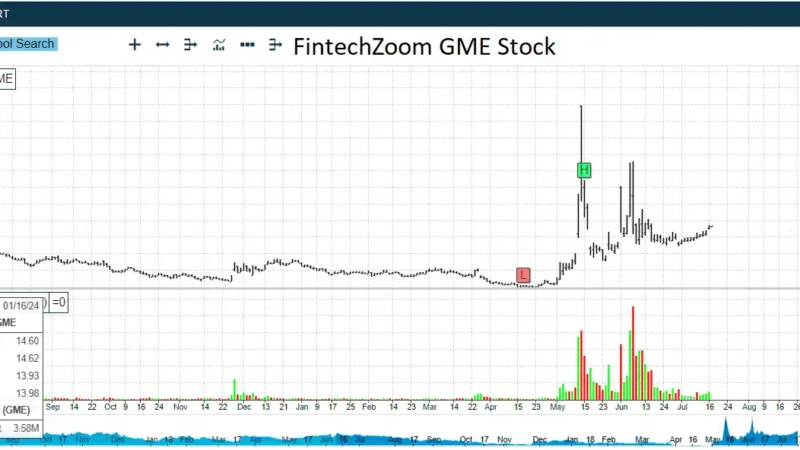

Technical Analysis

Market Trends and Patterns: Technical analysis involves studying market trends, price movements, and trading volumes to predict future stock performance. Utilize tools like moving averages and relative strength index (RSI) to make informed decisions.

Resources for Technical Analysis: Platforms like TradingView and Bloomberg offer comprehensive tools and data for conducting technical analysis.

Industry and Market Trends

Role of Industry Performance: The performance of a company is often influenced by its industry. Analyze industry trends, competitive landscape, and regulatory environment to gauge potential risks and opportunities.

Emerging Markets and Sectors: Identifying emerging markets and sectors can provide lucrative investment opportunities. Stay informed about technological advancements and shifting consumer preferences to capitalize on new trends.

Tips for Successful Stock Investment

Diversification

Importance of a Diversified Portfolio: Diversification reduces risk by spreading investments across various assets. A well-diversified portfolio can better withstand market volatility.

Strategies for Diversification: Consider diversifying across different industries, asset classes, and geographical regions. ETFs and mutual funds can also provide diversified exposure.

Risk Management

Assessing and Mitigating Risks: Evaluate the potential risks associated with each investment. Implement strategies such as stop-loss orders and position sizing to manage risk effectively.

Setting Realistic Investment Goals: Define your investment objectives and risk tolerance. Setting clear goals helps in making disciplined and informed investment decisions.

Long-term vs. Short-term Investment

Benefits and Drawbacks: Long-term investments benefit from compound growth and reduced trading costs, while short-term investments can capitalize on market fluctuations. Choose an investment horizon that aligns with your financial goals.

Aligning Strategy with Goals: Whether you aim for short-term gains or long-term wealth accumulation, tailor your investment strategy to match your objectives and risk appetite.

Final Thoughts

Investing in the stock market requires knowledge, strategy, and patience. Focusing on 5StarsStocks means selecting top-rated stocks known for strong performance and growth potential, increasing your chances of achieving significant returns while minimizing risks.

Continuous learning is crucial. Stay updated with market trends, news, and analyses. Use financial resources and expert opinions to keep informed. Diversifying your portfolio across sectors and asset classes spreads risk and capitalizes on various market opportunities.

Understand your financial goals and risk tolerance. Align your investment horizon with your objectives—whether building long-term wealth or seeking short-term gains. Emotional discipline is vital; stick to your investment plan despite market fluctuations to avoid impulsive decisions.

Consider seeking advice from financial advisors, especially if you’re new to investing. They can provide personalized guidance and help craft a diversified investment strategy tailored to your financial situation and goals.

Investing in 5StarsStocks enhances your portfolio’s growth and stability potential. By selecting high-quality stocks, staying informed, diversifying investments, and maintaining discipline, you can confidently navigate the stock market’s complexities. Here’s to your investment success in 2024 and beyond!

FAQs

1. What are 5StarsStocks?

Answer: 5StarsStocks are top-rated stocks selected based on their strong financial performance, market position, growth potential, and overall stability. These stocks are considered high-potential investments with a higher chance of substantial returns and lower risk.

2. How do I choose the right 5StarsStocks to invest in?

Answer: To choose the right 5StarsStocks, conduct thorough research on the company’s financial health, key performance indicators (KPIs), market trends, and industry position. Utilize resources like financial news websites, investment reports, and expert analyses to make informed decisions.

3. Is investing in 5StarsStocks risk-free?

Answer: No investment is completely risk-free. While 5StarsStocks are selected for their strong fundamentals and potential for growth, they still carry some level of risk due to market volatility and economic changes. Diversifying your portfolio can help mitigate these risks.

4. How can I stay informed about my 5StarsStocks investments?

Answer: Stay informed by regularly reading financial news, subscribing to investment newsletters, and following market analyses from reputable sources. Utilize financial tools and platforms that offer real-time updates, stock performance tracking, and expert insights.

5. Should I seek professional advice before investing in 5StarsStocks?

Answer: Seeking professional advice is recommended, especially if you’re new to investing. Financial advisors can provide personalized guidance, help you craft a diversified investment strategy, and offer insights tailored to your financial situation and goals, enhancing your investment success.