How FintechZoom GME Stock Redefined Investing

Introduction: The Perfect Storm

Remember the days when GameStop was just a place to trade in your old video games? Well, those days are long gone. In early 2021, GameStop (GME) stock experienced a meteoric rise that left Wall Street veterans scratching their heads and retail investors high-fiving each other in virtual forums. This wasn’t just a blip on the radar—it was a seismic shift in the financial landscape, orchestrated by a band of retail investors leveraging the power of social media. The phenomenon, dubbed the FintechZoom GME stock surge, encapsulates the dynamic interplay between technology, social media, and financial markets. Buckle up as we dive into the riveting tale of GME stock and its implications for the future of investing.

The Birth of a Legend: GameStop’s Humble Beginnings

From Babbage’s to GameStop: A Journey Through Time

Founded in 1984 as Babbage’s, a small software retailer, GameStop evolved into a giant in the gaming retail industry. Merging with Funco in 1999 to become GameStop, the company went public in 2002, making its debut on the New York Stock Exchange. For years, GameStop thrived as a leading retailer of video games and gaming merchandise. But as digital downloads and online gaming platforms gained traction, the once-mighty GameStop found itself grappling with an outdated business model.

The Tipping Point: Digital Transformation and Decline

The early 2000s were kind to GameStop, but the rise of digital distribution posed existential challenges. Gamers were increasingly downloading their favorite titles directly from online platforms, bypassing physical stores. GameStop’s revenue dwindled, and its stock price followed suit. By 2019, the company was struggling, and many financial analysts had all but written off GameStop as a relic of the past.

The Perfect Storm: Social Media Meets Wall Street

Reddit Revolution: The Rise of r/WallStreetBets

Enter r/WallStreetBets, a Reddit community where retail investors share tips, strategies, and memes about stock trading. In late 2020, members of this forum identified GameStop as a heavily shorted stock. Hedge funds were betting against GameStop’s success, expecting its stock price to plummet. But the Redditors had other plans. They saw an opportunity to execute a short squeeze—buying up GME stock to drive up its price and force short sellers to cover their positions at a loss.

The Short Squeeze: David vs. Goliath

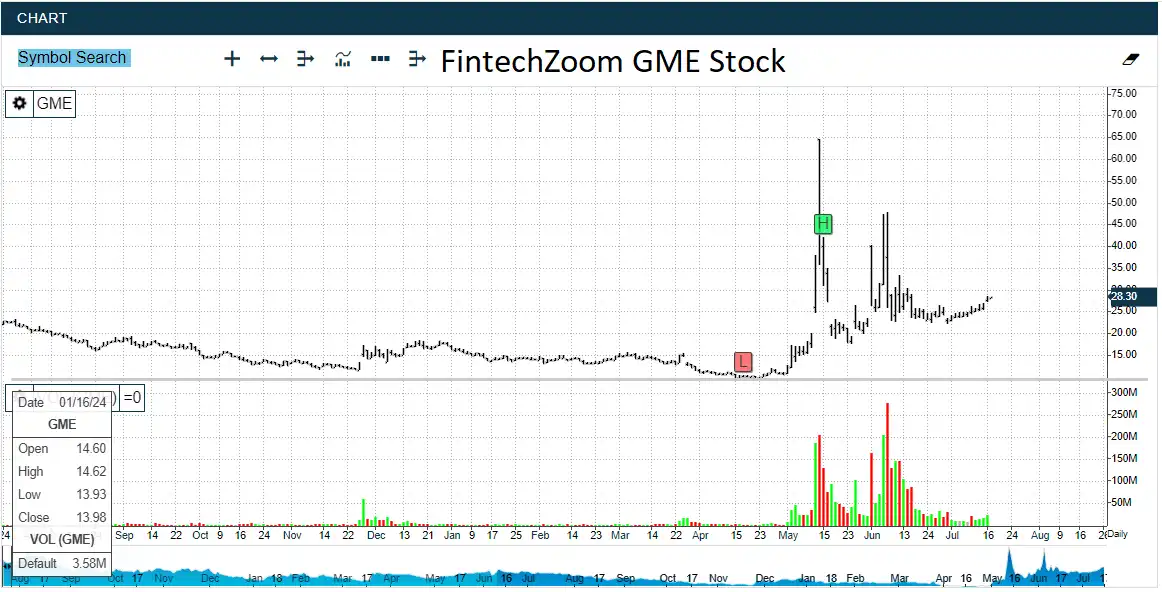

What happened next was nothing short of spectacular. In January 2021, the collective buying frenzy catapulted GME stock from around $20 to an astonishing $483 per share. The surge inflicted massive losses on hedge funds that had shorted the stock, most notably Melvin Capital, which required a $2.75 billion bailout to stay afloat. The David vs. Goliath narrative captured the public’s imagination, and suddenly, everyone was talking about GameStop.

The Mechanics of a Meme Stock: Understanding GME’s Volatility

Price Volatility: A Wild Ride

Investing in FintechZoom GME stock wasn’t for the faint of heart. The stock’s price exhibited extreme volatility, with wild swings occurring within hours. One minute, you were riding high on significant gains; the next, you were plummeting into the red. This kind of volatility was fueled by the speculative nature of the trades, driven more by social media hype than by the company’s fundamentals.

Trading Volume: A Frenzy of Activity

During the height of the surge, trading volumes for GME stock soared. Millions of shares changed hands daily, as both retail and institutional investors tried to capitalize on the momentum. The high trading volumes further amplified price movements, creating a feedback loop of buying and selling pressure.

Financial Health: The Reality Check

Amidst the frenzy, it was easy to lose sight of GameStop’s actual financial health. Despite the stock’s skyrocketing price, the company was still grappling with declining sales and profitability. GameStop’s pivot towards e-commerce and digital sales was in its early stages, and the long-term viability of these efforts remained uncertain. Investors had to weigh the thrill of short-term gains against the company’s underlying financial challenges.

Social Media and the Democratization of Finance

Power to the People: Retail Investors Take Charge

The FintechZoom GME stock surge wasn’t just about making money—it was about reclaiming power. For too long, Wall Street had been the domain of institutional investors and hedge funds, leaving retail investors on the sidelines. The GME saga flipped the script, demonstrating that retail investors, armed with information and a collective will, could move markets. It was a democratization of finance, enabled by social media platforms that facilitated coordination and communication.

The Role of Robinhood: Democratizing Trading or Curtailing Freedom?

Robinhood, the commission-free trading app, played a pivotal role in the GME stock surge. Its user-friendly interface and zero-commission trades made it the go-to platform for many retail investors. However, Robinhood faced backlash when it temporarily restricted trading in GME and other “meme stocks” at the height of the frenzy. Critics argued that the restrictions protected institutional investors at the expense of retail traders, while Robinhood maintained that the measures were necessary to manage risk and comply with regulatory requirements.

The Ripple Effect: Broader Implications for Financial Markets

Regulatory Scrutiny: A Call for Reform

The GME stock surge attracted the attention of regulators, who were concerned about the potential for market manipulation and systemic risk. Congressional hearings were held, and the Securities and Exchange Commission (SEC) launched investigations into the trading activities surrounding GME. The event underscored the need for updated regulations that could address the new dynamics of trading in the age of social media.

The Rise of Meme Stocks: Beyond GameStop

GameStop wasn’t the only stock to experience a meteoric rise driven by retail investors. Other companies, such as AMC Entertainment and BlackBerry, also saw their stock prices soar as they became the focus of social media-driven buying sprees. These “meme stocks” shared common characteristics: they were heavily shorted, had a strong nostalgic appeal, and were championed by retail investors looking to challenge the status quo.

The Future of Investing: A New Paradigm

The FintechZoom GME stock saga has left a lasting impact on the investing world. It highlighted the power of retail investors and the influence of social media on financial markets. Going forward, investors and regulators alike will need to navigate this new paradigm, where market dynamics are increasingly shaped by digital communities and viral trends.

Navigating the Risks: Lessons Learned from GME

Understanding Volatility: High Risk, High Reward

The GME stock surge was a stark reminder of the risks associated with high volatility. While some investors reaped substantial rewards, others faced significant losses. Successful investing requires a thorough understanding of the factors driving price movements and a willingness to manage risk appropriately. Diversification, risk management, and a long-term perspective are crucial components of a sound investment strategy.

The Importance of Due Diligence: Beyond the Hype

Amid the excitement of the GME stock surge, it was easy to get swept up in the hype. However, due diligence remains a fundamental aspect of investing. Investors should critically evaluate a company’s financial health, competitive position, and long-term prospects before making investment decisions. Relying solely on social media for investment advice can lead to misguided decisions and unexpected outcomes.

The Role of Emotion: Keeping Cool Under Pressure

Emotions ran high during the GME stock surge, with investors experiencing the full spectrum of fear, greed, and euphoria. Successful investing requires the ability to remain calm and rational, even in the face of extreme market movements. Emotional decision-making can lead to impulsive trades and significant losses. Developing a disciplined investment approach and sticking to a well-defined strategy can help mitigate the influence of emotions.

Conclusion: The Legacy of FintechZoom GME Stock

The FintechZoom GME stock phenomenon was a defining moment in the history of financial markets. It showcased the power of retail investors, the influence of social media, and the potential for dramatic market shifts driven by collective action. As the dust settles, the legacy of GME will continue to shape the investing landscape, prompting investors, regulators, and market participants to adapt to a new reality. Whether you view it as a cautionary tale or a triumph of the little guy, one thing is certain: the story of GME is far from over.

FAQs about FintechZoom GME Stock

1. What caused the surge in GameStop (GME) stock prices in early 2021?

Answer: The surge was driven by retail investors on Reddit’s r/WallStreetBets, who coordinated to buy shares and force a short squeeze, causing the stock price to skyrocket.

2. How did platforms like FintechZoom contribute to the GME stock phenomenon?

Answer: FintechZoom provided retail investors with real-time stock information, analysis, and trading tools, enabling them to make informed decisions and effectively coordinate their strategies.

3. What are the risks associated with investing in stocks like GameStop (GME)?

Answer: Risks include high price volatility, speculative nature, increased regulatory scrutiny, and concerns about GameStop’s long-term profitability and stability.

4. What strategic shifts has GameStop made in response to the changing market landscape?

Answer: GameStop has focused on increasing online sales, optimizing its supply chain, exploring NFTs, and hiring tech executives from companies like Chewy and Amazon to drive digital transformation.

5. What impact has the GME stock phenomenon had on the broader financial markets?

Answer: The phenomenon increased retail investor participation, highlighted market volatility, prompted regulatory considerations, and shifted power dynamics between retail and institutional investors.